The Digital Markets Act and The Digital Markets Competition and Consumers Act: Insights For Hoteliers

What is the Digital Markets Act (DMA)?

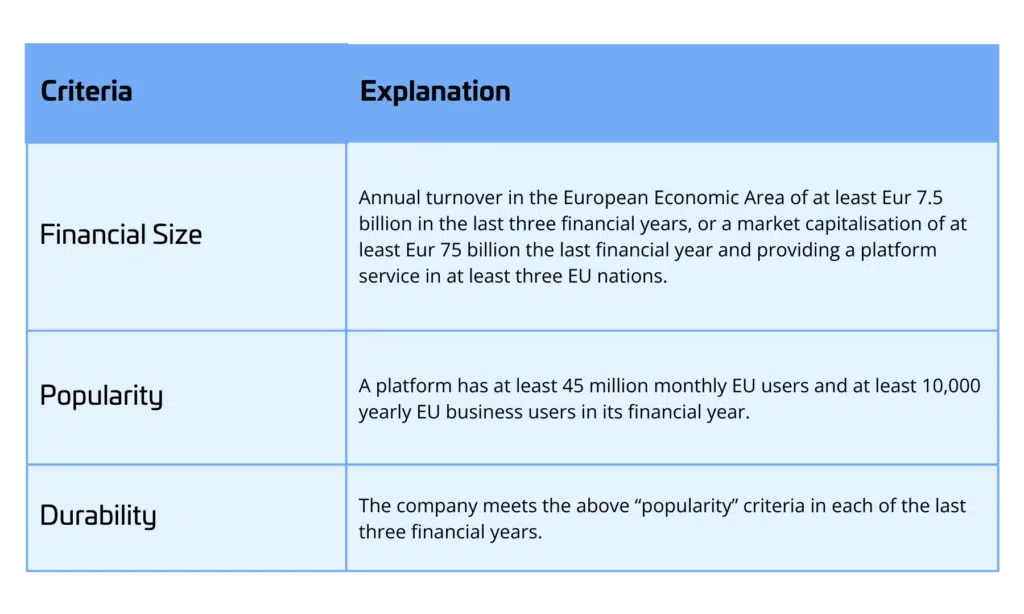

The Digital Markets Act was introduced in 2022 in the European Union as set rules for those called ‘gatekeepers’ in the digital world. They serve as important ‘gateways’ for businesses to reach their end users. The DMA aims to protect businesses and end users from potentially unfair conditions and ensure the transparency of important digital services such as apps and ads. The table below demonstrates the main criteria for who could be classified as a ‘gatekeeper’. The European Commission is an assessing body that determines which companies fall under the Act and is classified as ‘gatekeepers’. At this stage, only companies which have been designated as gatekeepers are subject to obligations. The presumed gatekeepers are able to appeal and provide arguments and evidence that, due to exceptional circumstances, they should not be considered as gatekeepers even though they meet all the criteria.

Source: Bloomberg, 2024

Who is currently affected?

Since September 2023, seven organisations so far have been identified as gatekeepers by the EU Commission, which are:

Alphabet (Google)

Amazon

Apple

ByteDance (TikTok)

Meta

Microsoft

Also designated under the DMA: Booking, designated by the Commission as a gatekeeper for its online intermediation service Booking.com on 13 May 2024.

Source: European Commission, 2024

The DMA will impose a variety of obligations that the gatekeepers will need to comply with and incorporate into their daily functions. One example of those obligations is to allow the end users to uninstall any pre-installed apps on their devices, or change their default settings on their operating systems, virtual assistants, or web browsers that steer them to the gatekeeper’s products and services and provide choice screens for key services. Another example is to allow business users to promote their offers and conclude contracts with their customers outside the gatekeeper’s platform (European Commission, 2024).

Source: European Commission, 2024

Why is the DMA important news to hoteliers?

Booking.com is an Online Travel Agent (OTA), and its services are widely used by hoteliers to reach new and existing customers. The popular accommodation booking platform Booking.com has been identified as a gatekeeper after submitting its self-assessment on 1 March 2024, based on the DMA criteria. Following their designation (May 2024), Booking.com will need to comply with the regulation within six months and submit a detailed report outlining the DMA compliance. Here are some key requirements:

No Rate Parity Clauses: Booking.com must allow hotels to offer lower rates and promotions on their own websites, which means they can no longer enforce rate parity clauses.

Fair Competition: Booking.com will need to ensure that its platform does not unfairly favour its own services over those of competitors.

Transparency: The company must provide clear and transparent information to both consumers and business users about the terms and conditions of its services.

Data Sharing: They will need to allow hotels to access the data that they generate in their use of Booking.com.

Our research shows that with For-Sight’s CRM and Marketing Platform, hotels can reduce reliance on OTA’s by, 19% on average. Booking.com will now be responsible for making your guest contact details visible to you. Many hotels didn’t have access to certain resources, but with the DMA controls, hotels in the European Union now do. To make the most of it, hoteliers need to have ”all data in one place” CRM platform where they can automatically create customer profiles based on the contact details and interactions with the hotel.

What is the impact of the DMA on Google Search and its significance for hoteliers?

Initially, the DMA aimed to create a fairer digital marketplace by curbing the power of major online platforms like Google. However, according to D-EDGE findings (June 2024), the changes have had unintended consequences for hotels:

Reduced Organic Traffic: Organic search results for hotels are now pushed further down the page, leading to a 20% drop in organic traffic to hotel websites.

Increased Paid Traffic Dependence: Hotels are seeing a surge in paid traffic and revenue, making direct distribution more expensive.

Higher Distribution Costs: The visibility of Online Travel Agencies (OTAs) has increased, while hotels face higher costs for direct bookings.

In the picture on the right, you can see search results in French Google for the Sheraton Grand Hotel & Spa in Edinburgh. We have highlighted the ‘sponsored’ content, which is visible first, including the official site as the top result. It shows that Sheraton Grand Hotel has paid for advertising, and Google should now favour the official sites (also by adding a blue badge) over OTA’s like Booking. If Sheraton Grand Hotel didn’t do Google Ads, their results would appear first AFTER all the sponsored sites; it could appear, for instance, as number ten in total on the list, meaning that it most likely would be invisible to the customer.

We anticipate further changes due to the DMA regulations and will keep a close watch to update our customers accordingly.

What about the UK?

The UK is following the EU’s example of the Digital Markets Act and planning to implement its own Digital Markets Competition and Consumers Act (DMCC), which has received Royal Assent.

According to GOV.uk (2024):

The Act will give the UK’s competition regulator tools to stop technology businesses with strategic power from misusing their position to disadvantage competitors and consumers.

The law will also create penalties for traders that break consumer protection law and allow the Competition and Markets Authority to enforce consumer law directly.

Under the rules, it will be easier for consumers to manage subscriptions by providing clearer pricing, banning fake reviews, and giving consumers greater control over what they purchase online.

Similar to the DMA, the affected companies (with strategic market status) will be chosen based on set criteria and by the Competition and Markets Authority. In the case that companies don’t comply within a set timeframe, they could be fined millions of pounds. The DMA enforces the same rules for all gatekeepers, while the DMCCA allows the Digitak Markets Unit (DMU) to create specific rules for each firm. This flexibility may lead to more targeted requirements, but could also slow down the process and make it more open to challenges (Osborne Clarke, 2024). Organisations are yet to be identified under the new Digital Markets Competition and Consumers Act.

What’s next?

Want to learn more about the DMA and DMCC? We will organise a webinar for hoteliers to dive deep into the subject. The dates will be announced soon. Want to be updated on the webinar dates and times? Sign up for our newsletter today!

—

This post originally appeared on the For-Sight blog here and is reproduced with their permission.

The post The Digital Markets Act and The Digital Markets Competition and Consumers Act: Insights For Hoteliers appeared first on Hotel Speak.