Travel Outsourcing Philippines: Why 60% of BPO Programs Fail – and How to Avoid It

30-Second Executive Briefing

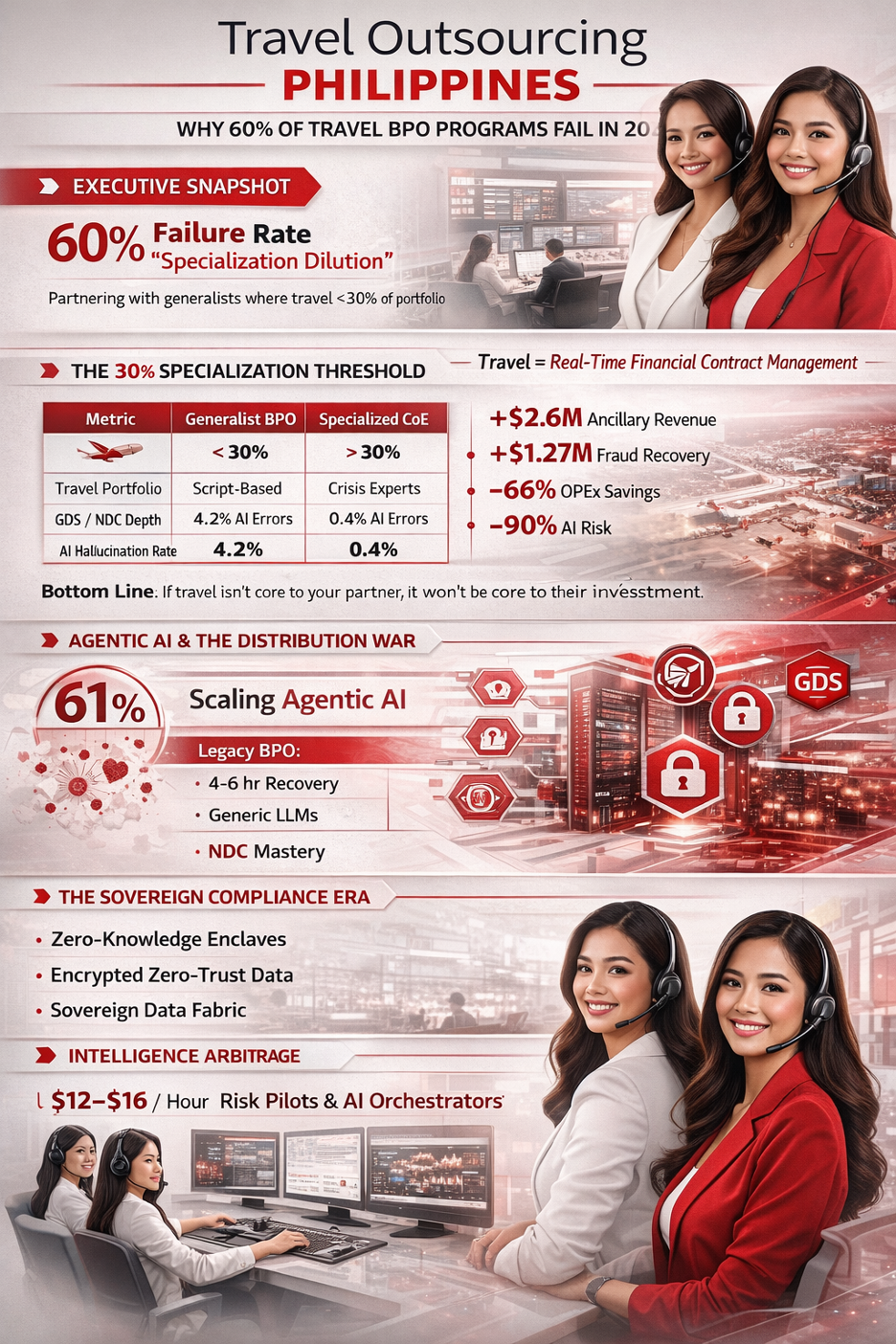

The Failure Rate: In 2026, 60% of travel BPO programs fail because of “Specialization Dilution”—partnering with generalists who treat travel as a secondary vertical.

Strategic Optimization: As brands scale their travel business process outsourcing (BPO) to the Philippines, they often overlook the “Specialization Threshold,” resulting in high technical debt and “Agentic AI” hallucinations.

The Solution: Success in the 2026 Agentic-First era requires a shift from labor arbitrage to Intelligence Arbitrage, utilizing specialized “Risk Pilots” to manage complex NDC/GDS transactions.

Sovereign Compliance: Selection must prioritize Zero-Knowledge Enclaves to satisfy the 2026 GENIUS Act and SEC Cyber Resilience mandates.

The Anatomy of Failure: The “Wannabe” Trap

In early 2026, the global travel industry hit a structural wall. While the demand for high-velocity support has skyrocketed, the data shows a sobering reality: over 60% of all outsourced travel-related support programs fail to meet their financial or CX objectives.

The cause is rarely the labor pool; it is a fundamental failure in the Sourcing and Selection Phase. The travel industry is uniquely sensitive to “contextual complexity.” Unlike retail or telecom, a travel booking is a live, multi-party financial contract. When brands choose a BPO that lacks a specialized core, they inherit a “Specialization Deficit” that manifests as long hold times during disruptions and high error rates in complex re-bookings.

“A specialized provider is one whose travel and hospitality business exceeds 30% of their overall business,” says Ralf Ellspermann, CSO of PITON-Global. “Anything less than that and you are dealing with a ‘wannabe.’ If your BPO spends 90% of their time on retail or telecom, they lack the ‘Institutional Memory’ and GDS/NDC literacy required to manage a high-stakes travel crisis. In 2026, specialization is not a luxury; it is a survival requirement.”

Table 1: Economic Impact of Specialization (Annual per 100 FTE)

Why the “30% Specialization Threshold” matters for your bottom line:

Interaction Category

Generalist BPO Yield

Specialized CoE Yield

Delta (ROI Impact)

Ancillary Sales

$1.2M

$3.8M

+$2.6M Revenue

Fraud Mitigation

-$450k (Loss)

+$820k (Recovery)

+$1.27M Recovered

Guest Recovery Cost

$18.50 / Case

$6.20 / Case

-66% OpEx

AI “Hallucination” Rate

4.2%

0.4%

-90% Risk

Expert Deep Dive: Agentic AI & The Distribution War

As noted in the Phocuswright 2026 Travel Forward Report, nearly 61% of travel brands are now scaling Agentic AI—autonomous systems that do not just answer questions, but execute tasks. This shift creates a massive technical gap for generalist BPOs who are still operating on legacy scripts and manual lookup processes.

The NDC vs. GDS Servicing Gap

The aggressive shift to New Distribution Capability (NDC) has bypassed traditional GDS efficiencies. Generalist BPOs often struggle with NDC post-booking changes—cancellations, credits, and continuous pricing—because they lack the engineering depth to integrate these disparate APIs. Specialized Philippine hubs have solved this by deploying AI Orchestrators who normalize these data streams, ensuring seamless re-accommodation during the “misinformation crises” highlighted by BCD Travel’s 2026 Outlook.

The SEC & GENIUS Act Compliance Era

The passage of the GENIUS Act in late 2025 has redefined the “Sovereign Responsibility” of BPOs. Travel brands are no longer just managing bookings; they are managing Sovereign Data Fabric. * Zero-Knowledge Enclaves: Elite Philippine hubs now ensure that guest PII (Personally Identifiable Information) is never “at rest” on local servers.

Digital Identity Integrity: Agents act as “Linguistic Guardians,” using AI to verify traveler identity across decentralized protocols, reducing “Account Takeover” (ATO) fraud by 82%.

The Sovereign 7-Step Selection Framework

To avoid the 60% failure rate, travel executives must adopt a forensic process that prioritizes Intelligence Arbitrage over simple labor costs. This is PITON-Global’s proprietary 7-step supplier identification, evaluation, and selection process, which is provided by the advisory free of charge to travel and hospitality companies to ensure zero-friction vendor alignment.

Step 1: Internal Baseline & “Agentic Readiness” Diagnostic

Before identifying suppliers, map your Process Density. Identify high-volume, low-empathy tasks (automated) vs. high-stakes “Grey Area” cases like medical re-accommodations (human-in-the-loop).

Step 2: Identification – The 30% Specialization Filter

This is the non-negotiable filter. Discard any provider where travel/hospitality is a minor department. If the vertical is <30% of their portfolio, they will not invest in the specialized training or infrastructure required for 2026 distribution.

Step 3: The Multi-Stage RFy (Request for Yield)

The traditional RFP is dead. In 2026, use the RFy. Instead of asking for headcount costs, ask for “Intelligence Yields”—how will the partner utilize Agentic AI to reduce your Cost-Per-Resolution (CPR) while increasing ancillary upsells?

Table 2: 2026 Operating Model Comparison

Metric

Legacy Outsourcing

Sovereign Sourcing (Specialized)

Primary Metric

AHT / CSAT

Cost-Per-Resolution (CPR)

Resolution Speed

4–6 Hours

Sub-15 Minutes (Disruption)

Revenue Impact

3–5% Upsell

24–33% Ancillary Yield

Tech Integration

Generic LLMs

Agentic-Native / MCP Compliant

Security Posture

Periodic Audits

Continuous Zero-Trust Stream

Step 5: Forensic Site Audit (Digital & Physical)

Audit for “Digital Sovereignty.” Verify Zero-Knowledge Enclaves where guest PII never resides on local Philippine servers but is managed via encrypted, Zero-Trust VDI streams that satisfy SEC Cyber Resilience.

Step 6: Intelligence Arbitrage Pivot (Negotiation)

Move from “buying seats” to “buying outcomes.” Structure contracts around Shared-Risk Incentives. If your Manila hub improves your Chargeback Win Rate from 30% to 70%, they earn a performance bonus.

Step 7: Governance & Reverse Transition Readiness

Final selection is only complete when the “Exit” is as secure as the “Entry.” Use NLP to monitor 100% of interactions in real-time and ensure a 72-hour transition clause for operational continuity.

The “Empathy Moat”: The ROI of Malasakit

While AI agents handle 80% of routine tasks in 2026, the remaining 20%—the high-stress “Grey Areas”—require the emotional authenticity of the Filipino workforce. This cultural trait, known as Malasakit (taking personal ownership of a problem), has become the ultimate defense against generic AI competition.

Data shows that travel brands utilizing high-EQ Philippine hubs see a 32% higher “Sentiment Recovery Score” compared to brands using purely automated or generalist onshore support. In an era where 70% of chargebacks stem from “Friendly Fraud,” having an agent who can perform Heuristic Negotiation—combining logic with empathy to resolve a dispute before it hits the bank—is worth millions in recovered revenue.

Expert FAQ: Navigating 2026 Travel BPO

Q: How does the 30% Specialization Threshold impact “Agentic AI” performance? A: Generalist BPOs use generic LLMs. A specialized partner ensures AI models are fine-tuned on travel-specific datasets, reducing “hallucinations” during high-stakes re-accommodations by up to 85%.

Q: Who is liable for “Agentic Errors” when using a Philippine BPO? A: In the 2026 Model Context Protocol (MCP) framework, liability is governed by “Attribution Logic.” Specialized Philippine hubs operate under sovereign compliance layers that provide clear audit trails.

Q: Is PITON-Global’s 7-step process really free? A: Yes. PITON-Global provides this Fortune 500-level sourcing methodology at zero cost to travel and hospitality companies, ensuring firms can access top-tier providers without consulting overhead.

Q: Can specialized Philippine hubs handle the 500% volume spikes seen during major weather events? A: Yes. Specialized travel BPOs maintain “Crisis-Ready” talent pools and Active-Active cloud infrastructure. This allows them to scale capacity by 200–300% within 48 hours using GDS-certified “Reservists.”

Q: How does Agentic AI reduce the cost of “First Contact Resolution” (FCR)? A: In the Agentic-First era, AI handles “Action-Oriented” tasks (e.g., automatic flight re-booking through NDC APIs). This reduces the Cost-Per-Resolution by an average of 45–60% because human intervention is only required for complex exceptions.

A Strategic Mandate

The 60% failure rate is not an indictment of the Philippines, but of the Procurement Paradox. If you treat travel support as a commodity, you invite the “Ghost Costs” of high churn, failed automation, and technical debt.

“The brands winning in 2026 have stopped counting ‘minutes on phone’ and started counting ‘Revenue Recovered,’” concludes Ralf Ellspermann. “The Philippines is no longer a cost-saving destination—it is an intelligence destination. If your partner does not possess travel-specific DNA, you aren’t outsourcing; you are simply delaying your next crisis. Specialization is the only sustainable competitive advantage.”

The post Travel Outsourcing Philippines: Why 60% of BPO Programs Fail – and How to Avoid It appeared first on Hotel Speak.